UnitedHealthcare (UHC) says that hospital labs cannot bill for non-patient outreach tests under their hospital’s facility participation agreement.

UHC has had this policy in effect for more than one year. What’s new is that UHC now appears ready to actually enforce it. Effective May 1, 2020, non-patient lab test claims submitted by hospital outreach labs will be denied if billed under the hospital’s facility participation agreement, according to UHC’s Network Bulletin for February 2020. UHC says that hospital outreach labs must get credentialed and contracted as an independent reference lab in order to get their non-patient lab test claims paid.

Enforcement of this policy could potentially eliminate many hospital outreach labs from UHC’s network and dramatically reduce reimbursement

for those labs that do get contracted and paid under independent reference lab fee schedules, notes Scott Liff, President and CEO of Kellison &

Company (Cleveland, OH).

UHC Requiring Hospital Outreach Labs

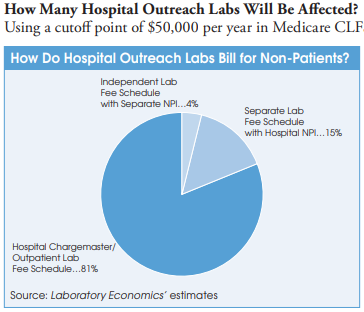

Liff says that the policy affects nearly all hospitals that provide non-patient lab outreach testing to UnitedHealthcare. The exception is roughly 100 hospital-owned independent labs (e.g., ACL Labs, Northwell Health, Tricore, et al.) that bill under their own distinct NPI and are already treated like independent reference labs with separate contractual agreements in place. In addition, a handful of the nation’s largest hospital-based outreach labs without their own unique NPI have also negotiated separate independent-lab-type fee schedules with private insurers.

However, most hospital outreach labs bill commercial insurance plans for non-patient lab tests using their hospital chargemaster and related outpatient payer contracts to get payment rates that typically range from 1x to 5x times the current Medicare CLFS. In some cases, hospital outpatient lab rates to private insurers are as high as nine times the Medicare CLFS. In contrast, Quest Diagnostics, LabCorp and independent labs are paid at rates well below the Medicare CLFS.

A UHC spokesperson says that the policy applies to all UHC commercial plans, fully-insured and administrative-services only (ASO). It does not apply to UHC’s Medicare or Medicaid plans. UHC covers a total of 27.8 million commercial plan members in the United States, including 8.6 million fully-funded health plan members and 19.2 million ASO members in self-insured employer plans. Among the states where UHC has its biggest share of the commercial insurance market are Nevada (66% share), Texas (32%), Arizona (25%), Connecticut (26%), Florida (23%), North Carolina (22%), New York (16%) and Illinois (16%).

Why Is UnitedHealthcare Doing This?

Liff believes the UHC initiative is designed to force hospital labs off using outpatient fee schedules for non-patient testing to reduced, market-based, reference lab fee schedules. This will significantly lower payments to hospital labs for non-patient testing.

Liff notes that credentialing and contracting with UHC as a commercial lab provider is not expected to be a quick process and might take as long as 90-180 days, if not longer, for hospitals to complete.

It’s important to note that hospital outreach labs do not have to change their licensure to an independent lab in order to continue providing non-patient lab services, but for reimbursement purposes the outreach lab will need to be recognized by UHC as a reference lab.

Liff adds that while it’s unclear if UHC intends to exclude certain hospital outreach labs from receiving contracts under this new initiative, hospital lab leaders should be wary of this possibility.

Will Other Commercial Insurance Plans Follow Suit?

Other private payers will be closely observing the response to UHC’s policy, says Jeff Myers, Vice President of Consulting at Accumen Inc. (Phoenix, AZ). He notes that private payers have been searching for effective ways to normalize payment rates made to hospitals, many of which have enjoyed premium payments from private payers for lab services for decades.

Myers adds that until Anthem’s “rate alignment” strategy in 2019, efforts to lower hospital rates had been largely ineffective. But he believes that UHC’s policy has the potential to have an even greater impact because it forces hospital labs to credential and contract with UHC as reference labs, or face denied claims for their non-patient lab testing.

Meanwhile, Myers anticipates that those hospitals that do credential and contract with UHC as a reference laboratory will likely see their non-patient lab payment rates decrease by 50% or more.

Hospitals that are already providing non-patient lab testing at competitive rates will have a distinct advantage over hospitals that have yet to make the market adjustment, adds Myers.