A Closer Look At The Exact Sciences-Genomic Health Deal

Last month, Laboratory Economics took an abbreviated look at Exact Sciences’ blockbuster deal to acquire Genomic Health. Below we provide a more in-depth review of some of the interesting aspects of the agreement.

The Bidding Process

In October 2017, Genomic Health commenced, with the assistance of Goldman Sachs, a search for a potential buyer. Goldman contacted a total of 27 entities, including Exact Sciences. Sixteen of the parties contacted, including Exact Sciences, entered into confidentiality

agreements and received management presentations by Genomic Health. Two parties offered preliminary bids, with one indicating a price range of $32 to $35 per share and the other at a range of $38.50 to $39.50 per share. These bids valued Genomic Health at approximately $1.2 billion.

Exact Sciences was not one of the bidders. Laboratory Economics speculates that the unnamed bidders might have included LabCorp, Quest Diagnostics, Myriad Genetics or Roche. In any case, following completion of due diligence, no final offers were made and the process ended without a

deal in February 2018.

Meanwhile, a little over a year later, Exact’s CEO Kevin Conroy had a change of heart and contacted Kim Popovits, Chairman and CEO of Genomic Health. At a dinner meeting with Popovits on J

une 13, Conroy proposed to acquire Genomic Health for $64 per share.

Conroy’s initial offer was rejected, but after a few weeks of haggling, Exact agreed to pay $72 per share, or approximately $2.78 billion, comprised of $1.06 billion of cash and $1.72 billion of Exact Sciences’ stock. The agreement was finalized late in the evening on July 28 and publicly

announced the next day.

Extraordinary Valuation

The deal is expected to be completed by the end of 2019. The purchase price works out to be $2.54 billion, after accounting for $244 million of cash and securities that Genomic Health has on its balance sheet. At $2.54 billion, Exact Sciences is paying 5.6x for Gen

omic Health management’s forecast revenue of $452 million in 2019, 34x its forecast EBITDA of $74 million, and 65x its forecast free cash flow of $39 million.

Golden Parachutes

Completion of the sale to Exact Sciences will trigger executive severance plan payments (i.e., golden parachutes) for Genomic Health’s top executives. For example, Popovits will receive a severance package of cash and vested options and restricted stock worth $13.4 million. Genomic Health’s Frederic Pla, PhD, Chief Operating Officer, will receive a package worth $5.7 million, and CFO Brad Cole will get $5.3 million.

Minimal Cost Synergies

Exact’s Conroy has described the combination of the two companies

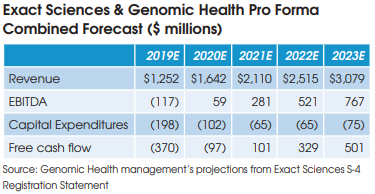

as a “1+1=3” situation. But financial projections contained in Exact Sciences SEC filing for the transaction project pretax operating synergies of only $8 million in 2020, $17 million in 2021, and $25 million annually thereafter.

These projected cost savings represent only 2% of the operating expenses at the combined companies and are comprised mainly of the elimination of public company costs at Genomic Health, including job cuts at the C-suite executive level.

The combined company is projected to become free cash flow positive in 2021.

Longer Term R&D Benefits

The addition of Genomic Health and its flagship OncoTypeDx test will help Exact Sciences diversify its business, now entirely dependent on its Cologuard colorectal cancer screening test.

Longer term, Katherine Tynan, PhD, President of Tynan Consulting LLC (San Francisco, CA), believes that Genomic Health’s very sophisticated R&D team and access to specialty oncologist channels may accelerate Exact Sciences’ development and commercial launch of new cancer tests. For example, over the past 20 years, Genomic Health has completed 125 clinical studies, covering multiple indications and been published in 156 peer-reviewed journal articles.

At the recent Baird Global Healthcare Conference, Exact’s CFO Jeffrey Elliot noted that Genomic Health employs 100 sales reps that market directly to oncologists in the United States. “They’ll enhance our ability to collect patient samples more rapidly….Patient samples are the biggest rate limiter to developing new diagnostic tests. You need samples to design your test and verify that it works,” explained Elliot.

New tests under development at Exact Sciences include a blood-based test panel of six DNA biomarkers designed to detect liver cancer for those at highest risk—people with hepatitis B or cirrhosis. Exact hopes to launch an LDT version of the test next year.

The Potential for a Liquid Biopsy for Colorectal Cancer

There are at least 13 companies that have developed or are developing liquid biopsy tests based on the detection of biomarkers in the blood (e.g., CellMax Life, Epigenomics AG, Freenome Inc., GRAIL Inc., et al.).

For example, Epigenomics AG received FDA approval for its liquid biopsy screening test for colorectal cancer, Epi proColon (Septin 9), in April 2016, and began offering the test commercially in May 2016. However, Tynan notes that the company has had a number of challenges, including PAMA,

on the way to payment and market access (CPT 81327: Medicare rate of $192). “They haven’t established intimacy with physicians and payers as the test is a distributed IVD, and the big commercial labs are difficult channels to raise awareness for new tests entering the market,” notes Tynan.

The real question is whether blood-based DNA analysis is a viable tool to enhance detection of advanced adenomas (precancerous lesions), according to Tynan. “Currently the literature suggests that benign colon lesions display extensive genetic heterogeneity, that they are not prone to release DNA into the circulation and are unlikely to be reliably detected with liquid biopsies, at least with the current technologies,” she adds.

Given these performance and evidentiary challenges, Tynan believes that FIT, colonoscopy, Cologuard and to a much lesser extent Epi proColon are likely to remain the only options for colorectal cancer screening for the foreseeable future.

PAMA Rate Adjustments Looming In 2021

As a final note, Laboratory Economics wonders if the second PAMA Medicare rate adjustment cycle motivated either Genomic Health or Exact Sciences to jump into each other’s arms. The privatepayer data collection period (January 1 through June 30, 2019) is over, so both companies have a

very good idea of where Medicare rates for their proprietary tests will be set for 2021-2023. CMS is scheduled to announce the new rates next summer.