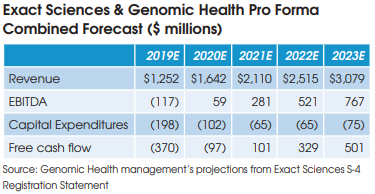

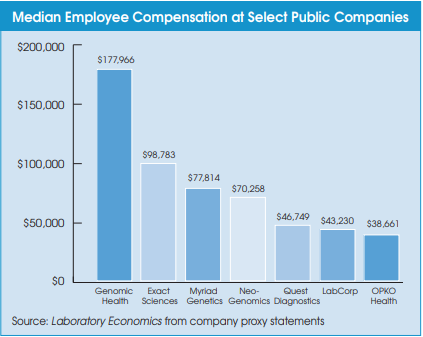

These projected cost savings represent only 2% of the operating expenses at the combined companies and are comprised mainly of the elimination of public company costs at Genomic Health, including job cuts at the C-suite executive level.

The combined company is projected to become free cash flow positive in 2021.

Longer Term R&D Benefits

The addition of Genomic Health and its flagship OncoTypeDx test will help Exact Sciences diversify its business, now entirely dependent on its Cologuard colorectal cancer screening test.

Longer term, Katherine Tynan, PhD, President of Tynan Consulting LLC (San Francisco, CA), believes that Genomic Health’s very sophisticated R&D team and access to specialty oncologist channels may accelerate Exact Sciences’ development and commercial launch of new cancer tests. For example, over the past 20 years, Genomic Health has completed 125 clinical studies, covering multiple indications and been published in 156 peer-reviewed journal articles.

At the recent Baird Global Healthcare Conference, Exact’s CFO Jeffrey Elliot noted that Genomic Health employs 100 sales reps that market directly to oncologists in the United States. “They’ll enhance our ability to collect patient samples more rapidly….Patient samples are the biggest rate limiter to developing new diagnostic tests. You need samples to design your test and verify that it works,” explained Elliot.

New tests under development at Exact Sciences include a blood-based test panel of six DNA biomarkers designed to detect liver cancer for those at highest risk—people with hepatitis B or cirrhosis. Exact hopes to launch an LDT version of the test next year.

The Potential for a Liquid Biopsy for Colorectal Cancer

There are at least 13 companies that have developed or are developing liquid biopsy tests based on the detection of biomarkers in the blood (e.g., CellMax Life, Epigenomics AG, Freenome Inc., GRAIL Inc., et al.).

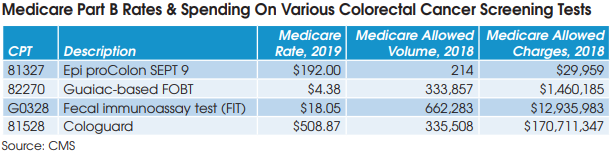

For example, Epigenomics AG received FDA approval for its liquid biopsy screening test for colorectal cancer, Epi proColon (Septin 9), in April 2016, and began offering the test commercially in May 2016. However, Tynan notes that the company has had a number of challenges, including PAMA,

on the way to payment and market access (CPT 81327: Medicare rate of $192). “They haven’t established intimacy with physicians and payers as the test is a distributed IVD, and the big commercial labs are difficult channels to raise awareness for new tests entering the market,” notes Tynan.

The real question is whether blood-based DNA analysis is a viable tool to enhance detection of advanced adenomas (precancerous lesions), according to Tynan. “Currently the literature suggests that benign colon lesions display extensive genetic heterogeneity, that they are not prone to release DNA into the circulation and are unlikely to be reliably detected with liquid biopsies, at least with the current technologies,” she adds.

Given these performance and evidentiary challenges, Tynan believes that FIT, colonoscopy, Cologuard and to a much lesser extent Epi proColon are likely to remain the only options for colorectal cancer screening for the foreseeable future.

PAMA Rate Adjustments Looming In 2021

As a final note, Laboratory Economics wonders if the second PAMA Medicare rate adjustment cycle motivated either Genomic Health or Exact Sciences to jump into each other’s arms. The privatepayer data collection period (January 1 through June 30, 2019) is over, so both companies have a

very good idea of where Medicare rates for their proprietary tests will be set for 2021-2023. CMS is scheduled to announce the new rates next summer.