Alabama-based investment management firm Harbert Discovery Fund continues to feud with Elazar Rabbani, PhD, Chairman and CEO of Enzo Biochem (New York City) over the future of the clinical lab and diagnostic products company.

Harbert is an activist investor fund that targets small-cap companies that it believes are undervalued. Harbert accumulated shares in Enzo from May to August 2019 at prices ranging from $3.07 to $3.65 per share. It currently owns 5.6 million shares, or an 11.7% stake, making it Enzo’s largest shareholder.

In February 2020, Harbert nominated and won Enzo board seats for two directors, Fabian Blank and Peter Clemens (see LE, March 2020). However, Clemens and Blank both resigned from Enzo’s board in November. “It appears that Chairman and CEO Rabbani has created such an extremely hostile environment that Pete and Fabian found their position untenable as minority members in opposition to Mr. Rabbani’s continued mismanagement,” according to a letter Harbert sent to Enzo’s board of directors on November 18. Harbert called for the resignation of Rabbani, followed by an immediate pursuit of the sale of the company. Harbert believes Enzo could be sold at a minimum of 2x its current annualized revenue, or $5.51 per share.

Dr. Rabbani, age 77, is a founder of Enzo and has served as the company’s Chairman and CEO since its inception in 1976. He holds a 4.1% stake in the company. His board seat is up for reelection to another three-year term this January.

In response to Harbert’s letter, Enzo filed a lawsuit against Harbert on November 27 in the Southern District of New York. Enzo alleges that Harbert has made material misrepresentations to Enzo’s shareholders and that its board nominees, Clemens and Blank, were unprepared and never proposed a single strategic plan to help Enzo. Enzo says that Harbert is seeking to “force a fire sale” to the detriment of shareholders. Enzo alleges that Harbert has made false or misleading statements in violation of Securities Exchange Act rules. Enzo is seeking a permanent injunction to stop Harbert from making future misrepresentations, correct past alleged false statements, and pay monetary damages to cover Enzo’s related proxy contest expenses and attorneys’ fees.

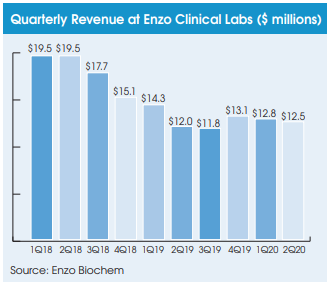

Enzo’s Revenue Jumps Driven by Covid-19 Testing

Separately, Enzo reported net income of $299,000 for the three months ended October 31, 2020 versus a net loss of $7.6 million for the same period a year ago; total revenue increased by 42% to $28.7 million.

Enzo’s Clinical Lab Division recorded a 66% revenue increase to $21.2 million. The improvement was driven by Covid-19 testing. Total volume grew to 300,000 accessions in the latest three month period versus approximately 200,000 a year earlier. Average revenue per accession increased to more than $69 per accession versus $62 in the previous year’s period.

Enzo Got $7 Million PPP Loan

The CARES Act expanded the U.S. Small Business Administration’s (SBA) business loan program to create the Paycheck Protection Program (PPP), which provides employers with loans for the purpose of retaining employees and maintaining salaries. PPP loans are wholly or partially forgivable if spent on payroll and certain other operating expenses. Enzo, which has 408 full-time and 40 part-time employees, was one of four publicly-traded lab companies that received a PPP loan. Enzo received a PPP loan of $7 million in April, while Interpace Biosciences received $3.5 million, Psychemedics got $2.2 million and Aspira Women’s Health (formerly named Vermillion) got $1 million.