Harbert Wins Two Board Seats At Enzo Biochem

Two nominees from the Alabama investment management firm Harbert Discovery Fund (HDF) have won board seats at Enzo Biochem (New York City), following a vote at Enzo’s delayed shareholders meeting on February 25. Fabian Blank and Peter Clemens now represent 40% of the voting power on Enzo’s five-person board. Shareholders rejected Enzo’s proposal to

amend the company’s bylaws to increase the size of the Board (see LE, February 2020).

The board seat of Elazar Rabbani, PhD, Co-Founder, Chairman and CEO of Enzo Biochem, is set to expire at the next shareholders meeting in early 2021.

HDF owns 11.8% of Enzo’s outstanding shares, making it the company’s largest shareholder. HDF has been pressuring Enzo to sell its drug development business and focus on its clinical lab business.

Separately, Enzo reported a net loss of $7.7 million for the three months ended January 31, 2020, compared with a net loss of $8.4 million for the same period a year earlier. Total revenue was up slightly to $19.4 million versus $19.3 million.

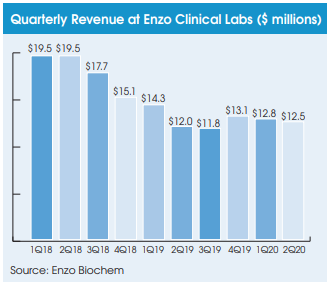

Enzo reported that its clinical lab division recorded revenue of $12.5 million for the quarter, up 4% from $12 million. Patient requisition volume was up 7%, while average revenue per requisition was down approximately 3%. Gross profit margin for Enzo’s clinical lab division was 18% in the most recent quarter versus 8% in the same year-ago period. Enzo attributed the margin expansion to cost cuts, including lowered outside reference testing expense and employee headcount efficiencies, partially offset by increased reagent cost from higher accession volume. On an annual basis, Enzo currently processes approximately 813,000 patient requisitions.

Enzo’s latest results suggest that the company’s clinical lab business has begun to stabilize after several years of severe pricing pressure related to the PAMA reimbursement cuts.