Top 20 Medi-Cal Laboratories

Top 20 Medi-Cal Laboratories

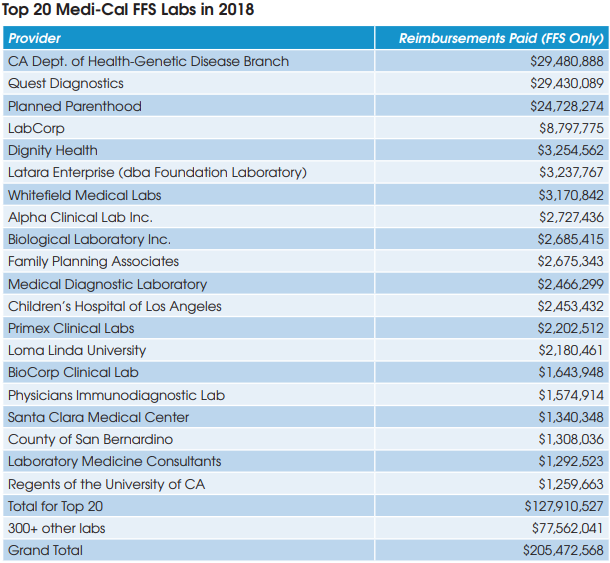

The largest Medi-Cal lab provider is The Genetic Disease Screening Program (GDSP) of the California Department of Health, which received $29.5 million of Medi-Cal FFS payments in calendar year 2018, according to the latest available data from DHCS. The Genetic Disease Screening Program provides prenatal and newborn testing services to Medi-Cal recipients.

Quest Diagnostics is second largest, with $29.4 million of Medi-Cal FFS payments. Planned Parenthood, which tests for sexually transmitted diseases, received $24.7 million, followed by LabCorp at $8.8 million.

The largest academic medical centers and hospital outreach labs on the list are Dignity Health, with $3.3 million of payments, followed by Children’s Hospital of Los Angeles, $2.5 million, and Loma Linda University, $2.2 million.

In total, the top 20 lab organizations collected $127.9 million of Medi-Cal lab test payments for FFS patients in 2018.