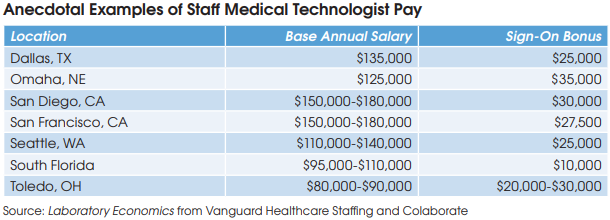

Today, laboratories are offering salaries and sign-on bonuses to medical technologists (MTs) that have never been seen before. In the San Francisco Bay Area and San Diego, lab clients are paying salaries as high as $150,000 and $180,000 to attract staff MTs with sign-on bonuses of more than $25,000, according to Ed Dooling, Chief Executive of Vanguard Healthcare Staffing (Sparta, NJ). He says MT salaries offered by independent labs in some markets have roughly doubled since the start of the pandemic.

PCR analyzers and Covid-19 test reagents were the bottleneck in the early months of the pandemic, but staffing shortages have proven to be a bigger and more persistent challenge. The pipeline of new MTs was disrupted as many labs temporarily shut down their clinical training rotations during the pandemic. In addition, older MTs retired to avoid exposure or got burned out due to extraordinary overtime demands. A huge increase in the number of new lab formations resulted in an intense competition for MTs, according to Dooling.

For example, independent labs in Toledo, Ohio are offering MT sign-on bonuses of $20,000 to $30,000 with salaries in the range of $80,000 to $90,000, according to Mason Shaw, Scientific Talent Recruiter at Vanguard. He notes that pre-pandemic salaries had ranged between $50,000 and $75,000 in this market.

Shaw notes that the length of time a new MT hire must stay before a sign-on bonus is paid varies by the lab company. “I have heard of a full year, 6 months, or 3 months, it depends on the offer and the negotiation.”

In addition, Shaw says that traveling MTs filling 3- to 12-month temporary positions are now being paid as much as $90 per hour. Pre-pandemic rates had averaged roughly $50-65 per hour for traveling MTs.

“Lab employees had always been treated like the red-headed stepchildren of healthcare. But the pandemic has raised their recognition and pay,” says Shaw.

Separately, Kevin Hunter, President of Colaborate (Tampa, FL), says his consulting firm helped set up 83 new Covid-19 PCR testing labs during the past two years. “We have seen $35,000 sign-on bonuses, significant relocation packages and starting salaries in the $125,000 range.”

For example, Hunter says that an independent lab in Dallas recently offered a salary of $125,000 plus a $25,000 sign-on bonus and six week’s paid vacation to hire an MT. “While some of this can be attributed to the retirement wave, the pandemic has put a tremendous burden on an

overworked staff, and with 50,000 new CLIA labs started since the beginning of Covid, there just aren’t enough workers to go around.”

Finally, Vanguard’s Dooling says that lab staff overtime hours have recently begun to decline as Covid test volumes have fallen. Nonetheless, he does not see the heightened MT salaries reverting to pre-pandemic levels. “It looks like this is the new normal.”