New Law For Medi-Cal Aimed At Eliminating Retroactive Recoupments

New Law For Medi-Cal Aimed At Eliminating Retroactive Recoupments

On July 27, California Gov. Gavin Newsom signed a comprehensive health care budget trailer bill (AB 133), which prevents future retroactive reimbursement reductions and recoupments from labs and pathology groups that occur due to “a lack of timeliness in Medi-Cal updating their rates.” In the past, Medi-Cal fee schedule rate changes have been chronically delayed, which has often led the program to seek retroactive recoupments from labs and pathologists—a major administrative and billing headache.

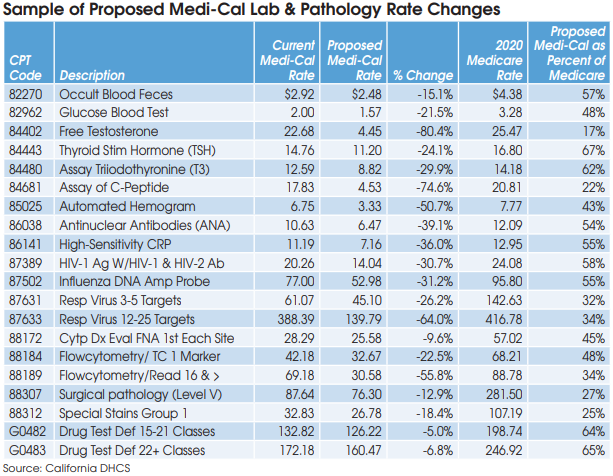

In addition, the new law has made a minor adjustment to the methodology used for setting MediCal fee schedule rates for clinical lab tests and pathology services. Beginning on July 1, 2022, Medi-Cal rates will be based on the lowest of the following: 1) the amount billed; 2) the charge to the general public; 3) 100% of the lowest maximum allowance established by the federal Medicare program for the same or similar services; or 4) a reimbursement rate based on an average of the lowest amount that other payers and other state Medicaid programs are paying for similar clinical laboratory or laboratory services.

The California Department of Health Care Services (DHCS) will not adjust rates currently established on the Medi-Cal fee schedule that do not exceed the limitations mentioned above, according to a DHCS spokesman. Some labs and pathologists had hoped the new law would raise their Medi-Cal rates to 100% of Medicare rates next year, but it does not.

The DHCS spokesman confirmed that the DHCS will continue to conduct its triennial rate survey and adjust rates based on the average of the lowest amounts third-party payers are paying. The next rate survey will be based on third-party payer data collected from calendar year 2021, reported in 2022 and effective in July 2023.