Medi-Cal Seeks Approval To Slash Lab Rates

California’s Department of Health Care Services (DHCS) has completed its

latest private-payer lab rate survey and is seeking federal approval to lower

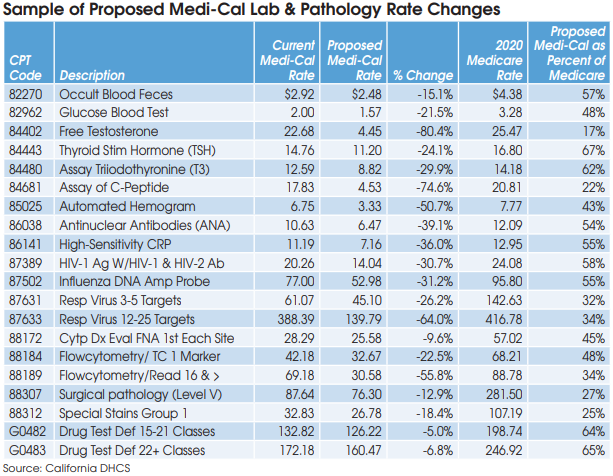

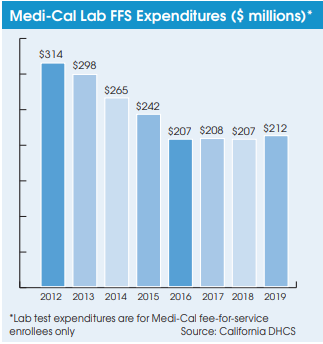

Medi-Cal fee-for-service (FFS) rates for more than 60 high-volume lab and pathology services (effective retroactive to July 1, 2020 upon federal approval). DHCS estimates that the proposed rate cuts will save Medi-Cal approximately $12 million annually from the $212 million per year it currently spends on FFS payments for lab and pathology services. If finalized, Medi-Cal rates for high-volume lab and pathology codes will fall to a range of as little as 17% current Medicare rates to a maximum of no more than 80%.

California’s Medi-Cal lab fee schedule has been pegged to private-payer rates since 2015. The new proposed rates are based on DHCS’s fourth private-payer rate survey, which required approximately 300 independent labs, hospitals and pathology groups in California to submit their 10 lowest private-payer rates received in calendar year 2018 for approximately 270 high-volume lab and pathology CPT codes.

Only 132 providers actually wound up submitting their pricing data, including 14 hospital labs and 118 independent labs. DHCS has the authority to suspend providers that don’t report. However, no lab suspensions have occurred to date.

DHCS took the submitted private-payer pricing data, threw out any rates higher than 80% of the current national Medicare rates, and then calculated its proposed Medi-Cal rates based on a weighted average of the remaining private-payer survey data.

The most severe rate reductions that will occur as a result of the latest survey include an 80% reduction in the Medi-Cal rate for CPT 84402 (Free Testosterone) to a proposed rate of $4.45. If finalized at $4.45, then Medi-Cal will be paying a rate equivalent to only 17% of the current Medicare rate of $25.47 for CPT 84402. This proposed rate is so low that it suggests a calculation error, notes Laboratory Economics.

Other codes with proposed Medi-Cal rate reductions so extreme that they may be erroneous include 84681 (C-Peptide), equivalent to 22% of Medicare; CPT 88307 (Surgical pathology-Level V), equivalent to 27%; and 88312 (Special Stains Group 1), equivalent to 25%.

California Clinical Lab Assn. Seeks Elimination of 80% Cap

In a letter to DHCS, the California Clinical Laboratory Association (CCLA) said that now is not the time to be substantially lowering reimbursements to labs which are playing a critical role in the fight against Covid-19. CCLA is supporting a bill (AB 1327) from California Assemblywoman Cottie Petrie-Norris that would eliminate the 80% of Medicare cap on Medi-Cal FFS rates for lab and pathology services. This bill was first introduced in February 2019.

CCLA attorney Kristian Foy says that there is no justification for the 80% cap given that Medicare CLFS tests were reduced by 10% per year between 2018 and 2020 under PAMA. Removal of the cap might allow Medi-Cal rates for some lab and pathology test codes to rise to up to 100% of current Medicare rates. Foy says that the 80% Medicare cap applied to California’s pricing data survey is undermining the purpose behind developing Medi-Cal’s California-specific market-based rates.

Furthermore, Quest Diagnostics, which is the biggest Medi-Cal lab provider (see page 4), has argued that national Medicare rates should not dictate rates in California because the implementation of PAMA relied on flawed and incomplete survey data. Other organizations supporting the Petrie-Norris bill include the California Association of Public Health Lab Directors, California Medical Association, LabCorp and Planned Parenthood Affiliates of California.

Finally, CCLA is also asking that the Assembly Bill 97 (AB 97) 10% reduction to Medi-Cal lab and pathology rates be eliminated. The AB 97 10% payment reduction, which applies to most Medi-Cal providers, was enacted during the California’s budget crisis of 2011 and has no sunset date.

A decision from CMS on the current proposed Medi-Cal lab and pathology rates is expected soon. The next DHCS private-payer data survey is scheduled to occur in 2022, and will be used to establish the July 1, 2023, Medi-Cal lab and pathology rates.

Meanwhile, Medi-Cal’s transition to using private-payer lab rates has helped it reduce its expenditures on lab testing for its two million fee-for-service (FFS) members from $314 million in 2012 to $212 million in 2019. Medi-Cal lab expenditures have also been tempered by a steady movement toward Medi-Cal managed care plans. Managed care plans are paid on a capitated basis, and they manage member care and negotiate and establish their own rates with their contracted providers. There are currently 10.3 million Medi-Cal members covered by managed care plans.

Medi-Cal Rates for Covid-19 Testing

Medi-Cal reimbursement rates for the new Covid-19 testing codes, including diagnostic testing (U0003 and U0004) and antibody testing (86328 and 86769), has been established at 100% of corresponding Medicare rates. In addition, the AB 97 10% reduction has been waived for the duration of the coronavirus crisis. Upon expiration of the public health emergency or national emergency, Medi-Cal rates for these codes will be lowered to 80% of Medicare and the AB 97 10% reduction will be applied.

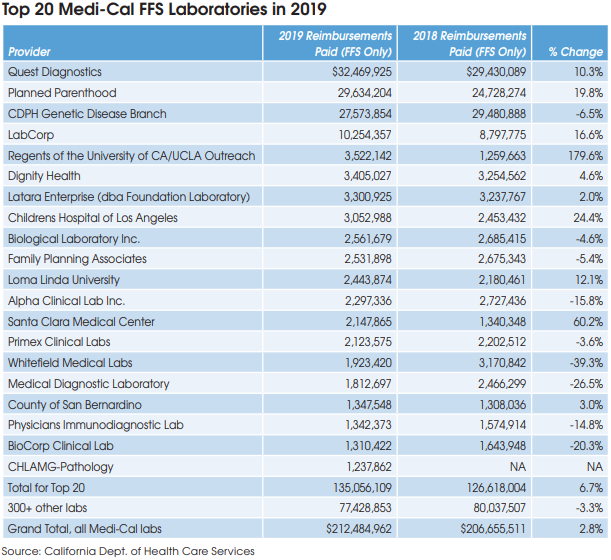

Top 20 Medi-Cal Laboratories

The largest Medi-Cal lab provider is Quest Diagnostics, which received $32.5 million of Medi-Cal FFS payments in 2019, up 10.3% from $29.4 million in 2018, according to data from DHCS.

Planned Parenthood, which tests for sexually transmitted diseases, received $29.6 million, up 19.8% from $24.7 million in 2018.

The Genetic Disease Screening Program (GDSP) of the California Department of Health is the third largest, with $27.6 million, down 6.5% from $29.5 million in 2018.

The Genetic Disease Screening Program provides prenatal and newborn testing services to Medi-Cal recipients.

LabCorp received $10.3 million of Medi-Cal payments in 2019, up 16.6% from $8.8 million in 2018.

The fastest-growing laboratory was Regents of the University of CA (aka UCLA Outreach Lab), where Medi-Cal payments jumped by 180% to $3.5 million in 2019. In total, the top 20 lab organizations collected $135.1 million of Medi-Cal lab test payments for FFS patients in 2019, up 6.7% from $126.6 million in 2018.