The Outlook for Medicare CLFS Rates

The Outlook for Medicare CLFS Rates

Without legislative action, Medicare rates for nearly 800 lab tests

will be cut by up to 15% effective January 1, 2026. “A lot of labs

have become complacent after five straight years of Medicare CLFS rate

freezes,” says Mark Birenbaum, PhD, Executive Director of the National Independent Lab Association (St. Louis, MO). “But they need to start thinking about the potential for rate cuts next year.”

Birenbaum says that NILA is working with the American Clinical Laboratory Assn. to introduce a new “PAMA-fix” bill within the next month or two. Any new bill would seek to delay the scheduled Medicare CLFS rate cuts for 2026 and ensure that hospital lab rates are correctly represented

in future private-payer payments surveys and rate calculations.

It’s too late to get a PAMA-fix into the Big Beautiful Bill currently being debated in the Senate.

The hope is that a PAMA-fix could get inserted into a major government funding or healthcare policy bill at the end of the year. But this will be a tough hill to climb, and time is running short.

Here’s an outline of three possible scenarios:

Scenario 1: PAMA Proceeds as Scheduled by Law

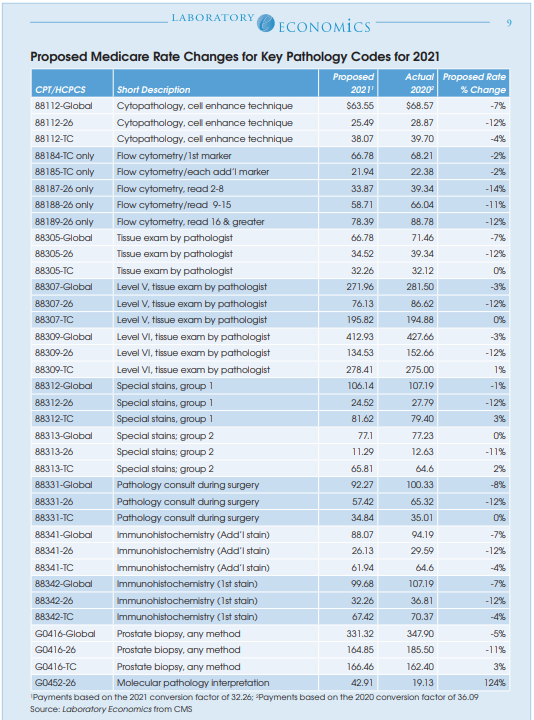

The first PAMA survey, which was based on private-payer lab rates from 2016, resulted in three straight years (2018-2020) of 10% cuts to most lab tests on the Medicare CLFS. A second PAMA survey and additional rate cuts were then frozen for five straight years (2021-2025).

Under current law, Medicare CLFS rates for approximately 800 lab tests will be reduced by up to 15% on January 1, 2026. See table on page 4.

In addition, the second PAMA survey is scheduled to begin on January 1, 2026. Independent labs, hospitals and large POLs are required to submit their private-payer volumes and reimbursement rates from the period January 1, 2019 to June 30, 2019 to CMS by March 31, 2026. CMS will use

this data to calculate new median private-payer rates to set the Medicare CLFS for 2027-2029.

Scenario 2: A PAMA-Fix is Introduced and Passed into Law

Despite widespread support from both Democrats and Republicans, the last PAMA-fix bill SALSA (H.R. 2377/S. 1000) failed to get passed into law. The culprit was cost. The Congressional Budget Office (CBO) had projected that passing SALSA into law would cost $6 billion over 10 years. A separate analysis by ACLA had estimated the cost at less than $3 billion.

ACLA is now crafting a new PAMA-fix proposal and seeking supporters to introduce it. A simpler and less costly alternative to SALSA is what’s needed.

There is little argument that current PAMA law pertaining to labs is unworkable. In particular, it will be nearly impossible for most hospital labs to dig up their private-payer volume and payment data from 2019 and report it to CMS, notes Josh Kramer, Managing Partner at the laboratory IT company Leap Consulting Group (Teaneck, NJ). Kramer says that many hospitals have gone through system upgrades and changes since 2019 and these hospitals may not have historical claims data readily available from legacy systems. In addition, PAMA does not allow hospitals to ignore paper claims data. And smaller hospitals may not have detailed lab data from paper claims loaded in their systems at all, according to Kramer.

A new PAMA-fix bill will need to include a mechanism (e.g., statistical sampling) to ensure that the higher rates paid to hospital labs are accurately surveyed and included in CLFS rate calculations.

Scenario 3: CLFS Remains Frozen and PAMA is Delayed Another Year

In previous scoring of one-year delays in PAMA payment cuts and reporting, the CBO assumed that private payers were adjusting their lab test reimbursement rates for inflation. Based on this assumption, the CBOconcluded that the suspension of PAMAwould result in cost savings. The CBO is no longer assuming private payer inflation updates. As a result, another one-year PAMA delay is unlikely to be scored to provide savings and thus unlikely to be passed into law.