True Health Diagnostics (Frisco, TX) filed for Chapter 11 bankruptcy protection on July 30, blaming CMS’s suspension of its Medicare payments since May 2017.

In its bankruptcy filing, True Health said it had less than $50,000 of assets, and more than $100 million in liabilities. The company’s largest unsecured creditors include the investment bank Houlihan Lokey Capital (owed $2 million), Roche Diagnostics ($1.8 million) and the law firm Perkins

Coie ($1.3 million).

True Health, which markets advanced lipid test panels, was founded in 2014 by its CEO Chris Grottenthaler. The company jumped in size when it purchased Health Diagnostics Laboratory (HDL-Richmond, VA) for $37 million from a bankruptcy court auction in late 2015. HDL went bankrupt in June 2015 soon after agreeing to pay the federal government $47 million to settle claims it paid kickbacks to physicians in the form of a $20 per specimen process and handling fee.

True Health operates a small lab and administrative office in the Dallas area and a 100,000-squarefoot lab in Richmond. Prior to its Medicare suspension of payments, the company had a total of 400 employees and estimated annual revenue of approximately $80-$100 million, including more

than $25 million from Medicare.

True Health’s problems began in May 2017 when CMS suspended its Medicare payments on the basis of “credible allegations of fraud.” As part of this suspension, CMS imposed a 100% hold of all Medicare payments to True Health for services rendered to Medicare beneficiaries. At the time, this

amounted to approximately $2 million per month, or about 30% of True Health’s total revenue.

In June 2017, CMS reduced the suspension to 35% of Medicare payments, withholding roughly $800,000 per month from True Health. But this June, CMS raised the suspension back up to 100% once again based on “credible allegations of fraud.”

True Health filed a lawsuit against CMS in early July seeking an emergency motion for a temporary restraining order. The company contends that it never received an adequate opportunity to challenge the merits of the suspension. “This Kafka-esque system, under which CMS can withhold over $20 million without an explanation or an opportunity to challenge the suspension, and continually extend and complicate the suspension…has left True Health in financial ruin,” according to the lawsuit.

A federal court dismissed True Health’s lawsuit on July 22, enabling CMS to continue withholding payments. True Health laid off 80 employees on July 29, and says that unless additional funding is found or a “white knight” appears, it may need to shut down by the end of September.

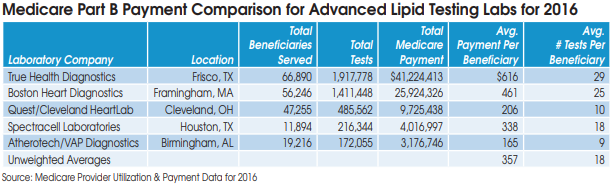

Prior to its problems with CMS, True Health had quickly risen to the top of advanced lipid testing labs. True Health served 66,890 Medicare beneficiaries in 2016 and received $41.2 million in Medicare Part B payments, according to data from CMS.