Latest Medi-Cal Private-Payer Payment Survey Underway

Latest Medi-Cal Private-Payer Payment Survey Underway

California’s Medi-Cal lab fee schedule has been pegged to private-payer rates since 2015. California’s Department of Health Care Services (DHCS) is currently in the midst of its fourth private-payer rate survey, which will be used to set Medi-Cal reimbursement rates for clinical lab and pathology services next year.

Approximately 300 independent labs, hospitals and pathology groups in California are required to submit their 10 lowest private-payer rates received in calendar year 2018 for approximately 270 high-volume lab and pathology CPT codes. The deadline for reporting the data to DHCS is June 30, 2019. The newly calculated Medi-Cal rates will be announced in June 2020 and will become effective July 1, 2020.

Labs are required to report if they have Medi-Cal paid claims volume of 5,000 or more per year, or Medi-Cal payments of $100,000 or more. Over the past three surveys, an average of about 100 labs per survey actually reported, representing less than 30% of the required labs. DHCS has the authority to suspend providers that are required to report, but fail to do so. However, no lab suspensions have occurred to date.

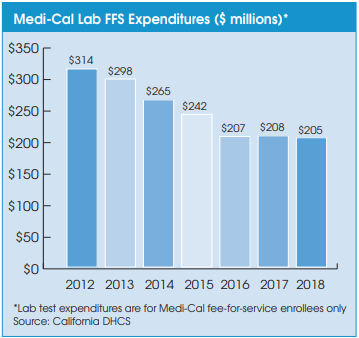

Medi-Cal’s transition to using private-payer lab rates has helped it slash its expenditures on lab testing for its 2.3 million fee-for-service (FFS) members from $265 million in fiscal year 2014 (ended June 30) to $205 million in fiscal year 2018. Medi-Cal lab expenditures have also been tempered by a steady movement toward Medi-Cal managed care plans. Managed care plans are

paid on a capitated basis, and they manage member care and negotiate and establish their own rates with their contracted providers. There are currently 10.7 million Medi-Cal members covered by managed care plans.

Medi-Cal currently reimburses clinical lab tests for FFS members at an average of approximately 79% of the Medicare CLFS for 2019. Medi-Cal rates for anatomic pathology services (i.e., CPT 88305) are set at approximately 60% of current Medicare Physician Fee Schedule rates.

The current Medi-Cal private-payer survey is especially interesting because it may provide an early glimpse into future Medicare CLFS rates. It will provide an early indication of the extent to which private health insurance plans in California were influenced by the first PAMAdirected 10% rate cut to the Medicare CLFS that took effect January 1, 2018.

It should also be noted that most

Medi-Cal providers, including labs,

remain subject to the Assembly Bill 97 (AB 97) 10% payment reduction that was enacted during the California’s budget crisis of 2011. Because AB 97 is a payment reduction, not a change to the actual rates, the 10% cut comes

off the listed Medi-Cal fee schedule rates. The 10% payment reduction authorized by AB 97 has no sunset date.