Is Alzheimer’s Testing the Next Big Lab Market?

Is Alzheimer’s Testing the Next Big Lab Market?

The FDA cleared the Alzheimer’s drug Leqembi (lecanemab) in July 2023. The drug marked the first treatment for slowing Alzheimer’s progression and cognitive decline to make it through the agency’s traditional pathway. But Leqembi, which was developed by Eisai (Tokyo) and Biogen (Cambridge, MA), has fallen far short of its goals for patient prescriptions. That’s partly because the current methods for diagnosing Alzheimer’s—ex- pensive brain imaging scans and invasive cerebral spinal fluid (CSF) tests— are acting as bottlenecks. However, new blood tests for Alzheimer’s are

being introduced that could give more patients access to treatment.

An estimated 6.9 million Americans aged 65 and older are currently living with Alzheimer’s disease, according to the Alzheimer’s Association (Chicago, IL). And an estimated 500,000 new cases of Alzheimer’s will be diagnosed this year. The new Alzheimer’s treatment Leqembi has a list price of $26,500 per year.

In addition, the FDA recently cleared Eli Lilly’s Alzheimer’s drug Kisunla (donanemab), which has a list price of $32,000 per year. Both drugs are intravenous infusions that attack a protein (amyloid) that clumps into plaques in the brains of people with Alzheimer’s. Both drugs slow disease progression (e.g., memory loss or other cognitive problems) but do not stop or reverse it. In addition, at least nine pharmaceutical companies have clinical trials underway for new Alzheimer’s drugs. Those in late-stage trials for oral pill treatments include BioVie (NE3107) and AB Science (masitinib).

But these drugs rely on PET scans and CSF tests to identify Alzheimer’s patients for treatment. “The availability of more affordable and minimally invasive diagnostic tools will help support broad access for the management of Alzheimer’s disease,” according to Eisai’s global Alzheimer’s disease officer, Keisuke Naito.

New blood-based immunoassays that identify the proteins associated with Alzheimer’s are likely to become the new standard for screening and monitoring the disease. The potential lab market could reach $500+ million per year. This estimate assumes 4 blood tests to identify and monitor each of the 500,000 new cases of Alzheimer’s each year at an average reimbursement of $260 per test (for two protein markers per test).

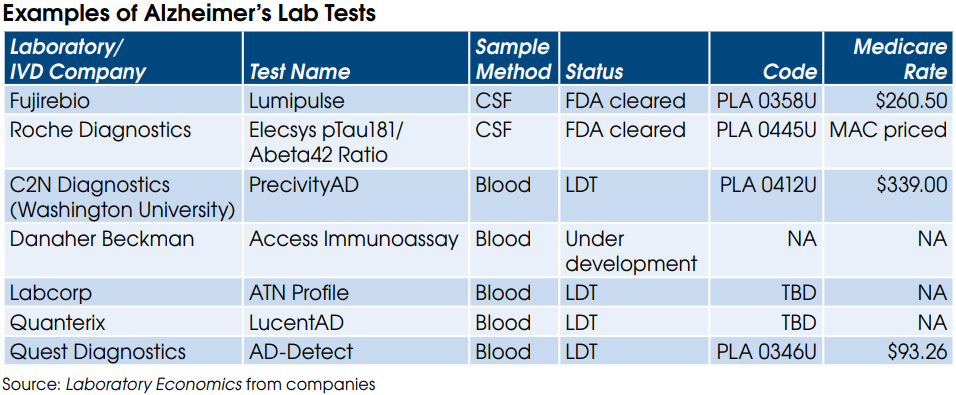

At the June 25th Annual CLFS Meeting with CMS to address rate setting for new codes, ACLA requested a Medicare rate of $130 per Alzheimer’s protein marker. Thus, a two-protein test (e.g., pTau181 & Abeta42) would be reimbursed $260. This level of reimbursement would match the Medicare rate of $260 for Fujirebio’s FDA-cleared Lumipulse test. Coding and final rates will be announced by CMS later this year for an effective date of January 1, 2025.

There are currently at least six Alzheimer’s lab tests on the market (see table). In addition, Danaher’s Beckman Coulter is developing a blood test for its immunoassay analyzers. Beckman is expected to release a two-protein test (pTau217 & Abeta42) in RUO format later this year. Clinical data from the RUO test will be used to support an eventual FDA application.