The Pandemic Intensified Chronic Lab Worker Shortage

The Pandemic Intensified Chronic Lab Worker Shortage

There are approximately 338,000 clinical laboratory technologist and technician jobs in the U.S., according to the U.S. Bureau of Labor Statistics. Hospitals account for 47% of these jobs; independent labs, 20%; physician offices, 9%; schools and universities, 6%; and other settings, 18%. While the Covid-19 pandemic has increased the visibility of the clinical lab industry, it has also intensified the chronic shortage of lab workers. A new report (The Clinical Laboratory Workforce: Understanding the Challenges to Meeting Current and Future Needs) published by the American Society for Clinical Pathology (ASCP) and the Center for Health Workforce Studies at the University of Washington, provides an in-depth look at the lab worker shortage and strategies to increase the pool of qualified personnel. For more insight, Laboratory Economics spoke with the study’s lead author Edna Garcia, MPH, Director, Scientific Engagement and Research at ASCP.

How has the pandemic worsened the lab worker shortage?

It’s made it difficult for students studying medical laboratory science to get onsite at clinical rotation sites. Many sites didn’t want students due to Covid-19, and some programs turned away students weeks before they were scheduled to start rotations. As a result, the pipeline of new histotechnicians, medical laboratory technicians and phlebotomists entering the workforce has been disrupted.

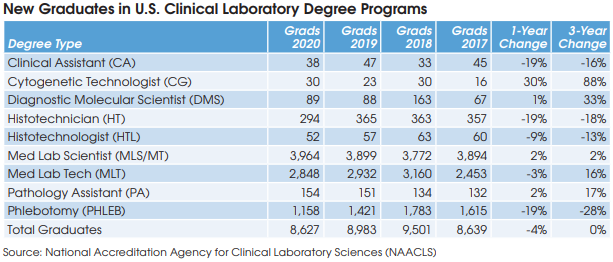

There were steep declines in the number of new histotechnicians, histotechnologists, medical lab technicians and especially phlebotomists last year [see table].

At the same time, labs have experienced higher-than-average staff departures mainly due to early retirement taken by employees with health concerns. Some lab employees in the age range of 55-64 have retired early because of burnout and/or fear of catching Covid.

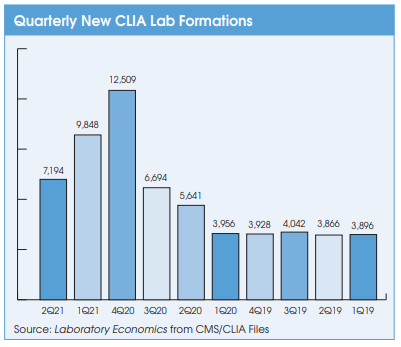

Finally, there has been increased demand for lab workers due to the high volume of Covid-19 testing, demand for rapid turnaround time, and the thousands of new Covid-19 testing labs that have

What’s your take on the high sign-on bonuses being used to attract lab workers?

For more than 20 years, labs have competed for workers by offering sign-on bonuses. What’s new is the size of the bonuses, which have increased from roughly $1,000 to $5,000 in the past, to as much as $10,000 to $20,000 currently. Labs are also now frequently tying sign-on bonus payouts to required employment of two years or more to prevent “lab jumping.” We’ve also seen institutions that offer to pay for licensure fees, discounts on car/homeowners insurance and cellphones.

Which positions are in highest demand?

Medical lab technicians, histotechnicians, and phlebotomists have the highest vacancy rates. We also see many opportunities in molecular pathology departments, and the need for technologists with molecular biology (MB) and molecular pathology (MP) certifications.

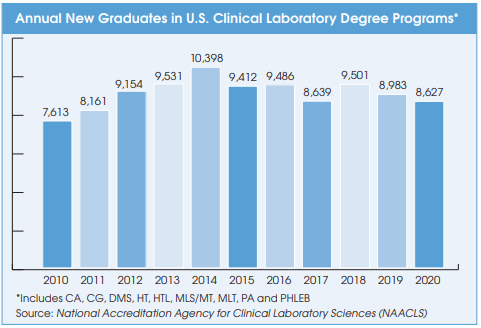

The long-term trend in new clinical laboratory science program graduates is flat.

Yes, the total number of new graduates for all lab degrees (HT, HTL, MLS/MT, MLT, etc.) has been stable for the past 10 years (see chart). But stable isn’t good enough to keep up with the growing demand.

Will increasing technology and automation alleviate the worker shortage in the lab?

From our data and conversations with lab staff and managers, the role of lab professionals is going to change with automation, but it’s not going to reduce the number of techs required. There will be a need for staff who are knowledgeable in using and operating these machines in the near future.

What can be done to increase the pool of qualified personnel?

Our report outlined three strategies. Number one, we’ve got to raise awareness of lab career opportunities at an earlier age. Specific activities and program content geared toward elementary and middle school students are needed. Incentives should be offered to encourage lab employees to participate in educational and awareness-building activities at elementary schools.

We’ve also got to do more to improve workforce retention. Too many lab employees leave the field to pursue new careers by enrolling in nursing or medical school. We need to keep existing employees by providing more opportunities for career growth through tier levels, increases in pay, and

elevated titles.

Finally, we’ve got to encourage diversity in academic recruitment by partnering with STEM programs to recruit students from underrepresented groups, developing more scholarships, and recruiting more men, the non-dominant gender in this field.