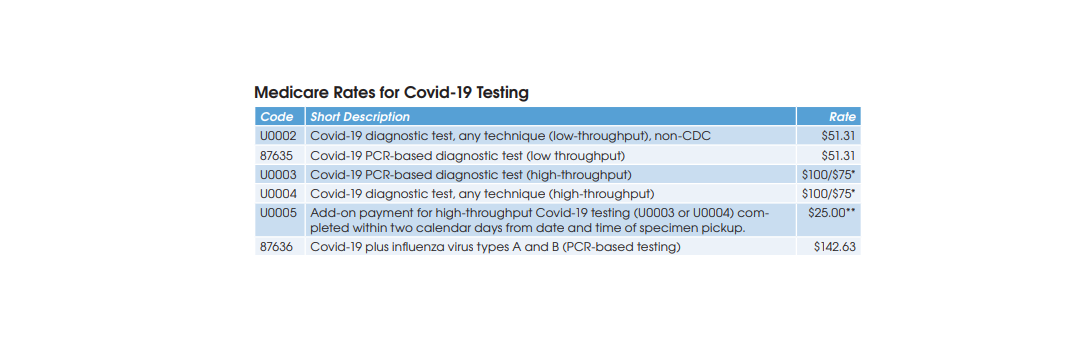

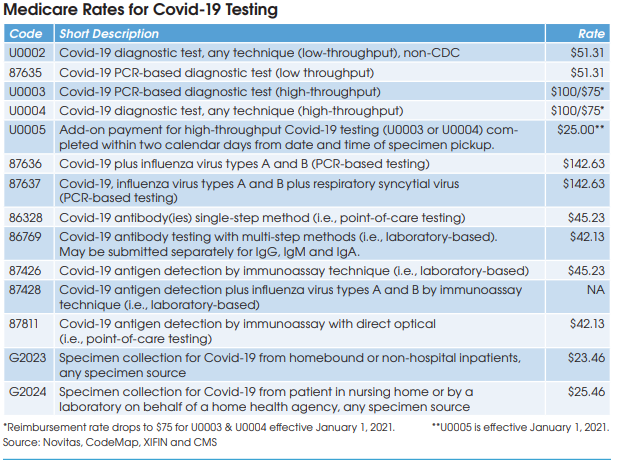

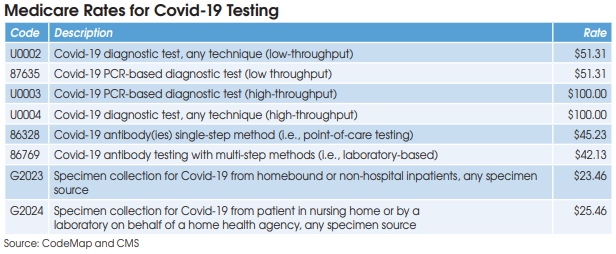

CMS has been very fair when establishing reimbursement rates for Covid-19

tests in an effort to encourage widespread diagnostic and antibody testing.

Furthermore, private health plans are required to cover both diagnostic and antibody testing without member cost-sharing (copays or deductibles) as a result of the Families First Coronavirus Response Act (FFCRA). “Most private insurers have been uncharacteristically reasonable in establishing their rates and working with labs to fix claims processing errors for Covid-19 testing,” notes Lale White, Chairman & CEO at XIFIN Inc. (San Diego).

High-Throughput Covid-19 Diagnostic Testing

Covid-19 diagnostic testing on high-throughput testing systems (200+ specimens per day; e.g., Roche cobas 6800/8800, Abbott m2000 System, Hologic Panther Fusion System, et al.) is billed using HCPCS U0003 or U0004 at a Medicare rate of $100. XIFIN’s White says that her firm has

seen 89% of private insurance claims for U0003 and U0004 paid at or above Medicare’s rate, and only 11% underpaid. She says that underpayment most commonly occurs with BCBS plans, which are frequently paying for high-throughput Covid-19 testing at the low-throughput rate of $51.

Low-Throughput Covid-19 Diagnostic Testing

CMS has established two codes (HCPCS U0002 and CPT 87635) for low-throughput Covid-19 diagnostic testing systems (<200 specimens per day) and set reimbursement at $51.31. Aetna and Cigna are paying equivalent rates, according to Scott Liff, President & CEO at Kellison & Company (Cleveland, OH). Similarly, UnitedHealthcare and many BCBS plans are allowing $51.31, according to Deb Larson, Executive Vice President at TELCOR Inc. (Lincoln, NE). In addition, several big state Medicaid plans, including California, Illinois and New York, have set their fee-for-service rates for U0002/87635 equivalent to Medicare.

Covid-19 Antibody Testing

Medicare reimbursement for Covid-19 antibody testing has been set at $45.23 for CPT 86328 (point-of-care tests) and $42.13 for CPT 86769 (laboratory-based multi-step methods). These are very favorable rates when compared with other antibody test codes for infectious agents that are

reimbursed by Medicare at rates between $8.93 and $19.35, according to Charles Root, PhD, President of CodeMap LLC (Chicago). He notes that labs testing for two antibodies (IgM and IgG) can bill CPT 86769 twice for total Medicare reimbursement of $84.26.

Unfortunately, White says that private insurer reimbursement of Covid-19 antibody testing is more problematic. Most private payer claims for CPT 86769 are being reimbursed below the Medicare rate. For example, some BCBS plans are paying between $12 and $35, with an average of roughly $20, according to White. Similarly, TELCOR’s Larson has seen BCBS rates in the range of $12 to $20, while Kellison’s Liff has seen rates of between $15 and $18 from Cigna.

In addition, some private insurers have taken the position that antibody testing should not be covered if it’s part of an employer-based testing effort for bringing their staff safely back to work, even if the testing is voluntary and performed under a doctor’s order. This flies in the face of the CARES Act, which is intended to promote both Covid-19 diagnostic and antibody testing for anyone that wants it, notes White.

Claims Denial Rates for Covid-19 Testing

Early on in the pandemic (March/April), White says that XIFIN was seeing denials and balance bill errors occurring on about 22% of the Covid-19 test claims it processed. The most common denial and adjudication errors involved medical necessity denials and improper processing of patient

co-pays and deductibles.

However, White says that most payers have readily acknowledged their adjudication errors, made corrections and reprocessed claims with very few requesting a resubmission.

On current claims through the end of May, White says that initial denial rates have fallen to 7% with co-pay/deductible errors at less than 1%. “We expect that 7% medical necessity denial rate to get down to 4% to 5% after we make some calls to correct the remaining denial adjudication errors.”

Similarly, Larson says that TELCOR is currently seeing initial denial rates of 5% to 9% on Covid-19 test claims with the primary source of denials related to member insurance coverage eligibility.

Challenges for Out-of-Network Labs

White notes that one issue that has not been resolved is the continuation of BCBS payer policies that reimburse patients directly for out-of-network (OON) lab test claims. This forces OON labs performing Covid-19 testing to seek payment from patients. “With bad debt rates as high as 50% on direct patient billing and all the added costs involved with identifying a direct patient payment, it is not prudent for the Blues to take a position of penalizing labs that are OON during a time when extensive testing capacity is being demanded at the federal, state and local level for management of the pandemic,” observes White.

Specimen Collection Rates for Covid-19

On March 30, CMS announced the creation of new Covid-19 specimen collection HCPCS codes (G2023 and G2024) at very favorable rates.

HCPCS G2023 is intended for independent labs that collect Covid-19 specimens (by any specimen source) from homebound or non-hospital patients. Medicare reimbursement has been set at $23.46.

HCPCS G2024 is intended for independent labs that collect Covid-19 specimens (by any specimen source) from patients in a nursing home or on behalf of a home health agency. Medicare reimbursement has been set at $25.46.

CMS says that these new specimen collection codes will remain in effect until it has determined that the Covid-19 pandemic is over.

The rates for G2023 and G2024 are far above Medicare’s existing $5 rate for G0471 paid to labs for non-Covid-19 blood collection services provided to nursing home patients or on behalf of a home health agency.

However, the catch is that nearly all Covid-19 diagnostic test samples are nasal swabs that are collected by nurses, not lab-employed phlebotomists (see page 6 for more).

The new Covid-19 specimen collection codes do apply to lab-employed phlebotomists that collect blood samples for Covid-19 antibody testing from nursing home or homebound patients. However, demand for antibody testing has been weak to date.