LabCorp Mid-Year 2020 Review

LabCorp Mid-Year 2020 Review

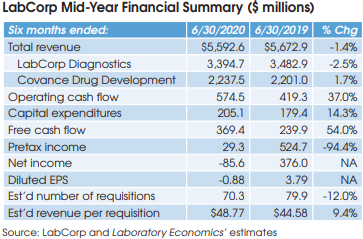

LabCorp (Burlington, NC) reported a net loss of $86 million for the six months ended June 30, 2020, down from net income of $376 million in the same period for 2019. Overall, LabCorp’s reported half-year revenue was down by 1.4% to $5.593 billion.

Looking specifically at LabCorp’s lab testing business, revenue was down 2.5% to $3.395 billion, including 1.4% gained from acquisitions. On July 28, the company held a conference call with analysts and investors to discuss its mid-year results. Here’s a summary of some key topics discussed:

Volume Trends

Total volume (measured by requisitions) decreased by 12%, as organic volume declined by 13.4%, partially offset by acquisition volume of 1.4%. The decline in organic volume included a 21% reduction in base business (due to the pandemic), partially offset by Covid-19 testing of 7.6%. LabCorp reports that its base business improved to an approximate decline of 17% in the month of June versus a year ago, which was more than offset by Covid-19 testing, which contributed roughly 23% to total volume in June.

Pooled Covid-19 PCR Testing

As of the end of July, LabCorp was performing an average of roughly 125,000 Covid-19 PCR tests per day and had capacity to perform up to 180,000 tests per day. LabCorp says its average turnaround time for hospitalized patients was at 1-2 days, with 2-3 day TAT for other patients.

On July 24, LabCorp received FDA emergency use authorization (EUA) to perform pooled Covid-19 PCR testing on up to five patient samples at a time. A positive result would require each sample to be individually retested “I believe that the standard PCR testing in the fall will remain the most significant by far of the testing that we do for PCR. But, I do think that the pool testing will add to our capacity and give us additional capabilities,” said LabCorp CEO Adam Schechter.

Covid-19 Antibody Testing

As of the end of July, LabCorp was performing an average of approximately 8,500 Covid-19 antibody tests per day and had capacity to perform up to 300,000 tests per day.

New Acquisitions

LabCorp acquired RDL Reference Laboratory (Los Angeles, CA) in mid-June. RDL was formed in 1977 by two UCLA-trained rheumatologists, Robert Morris, MD, and Allan Metzger, MD. RDL specializes in rheumatologic and autoimmune testing with the majority of its business coming from Southern California.

In July, LabCorp acquired the outreach testing business and entered into a comprehensive laboratory services contract with Franciscan Missionaries of Our Lady Health System (Baton Rouge, LA), one of the largest health systems serving Louisiana and Mississippi.