Tips For Negotiating Your Lab’s Next Reference Testing Contract

Tips For Negotiating Your Lab’s Next Reference Testing Contract

Reference (aka send-out) testing expenses average between 5% and 10% of the overall budget at most hospital laboratory departments. “Everybody thinks they are getting a good deal, but most have not wrung out the lowest prices available from their reference lab,” notes Steve Mattice,

President of the hospital lab consulting firm J.A. Mattice & Associates (Portland, OR). Below we highlight some of Mattice’s key tips and observations.

What’s the “hot list” in terms of send-out tests?

This is the list of 10 to 100 higher-volume send-out tests that the big reference labs (ARUP, Labcorp, Mayo and Quest Diagnostics) will discount the most in order to win a contract. But it’s a diversion because they offset their lower prices on the recognizable tests with much higher prices on lower-volume send-out tests. Each of the major reference labs is most focused on the overall profitability of their reference testing contracts.

How can hospitals negotiate for the best overall reference testing contract?

The key is knowing the lowest price that the major reference labs are willing to provide for each specific send-out test. We have helped negotiate more than 100 reference testing contracts over the past 30 years and have maintained a database of the lowest prices we have found for send-out tests from the four largest reference labs. Every time we find a lower price for the same test code, we keep track of it, and it becomes our new standard price for negotiations. When negotiating a new send-out testing contract, we will typically analyze the total annual costs for all send-out tests at a hospital client.

What kind of pricing variation is there?

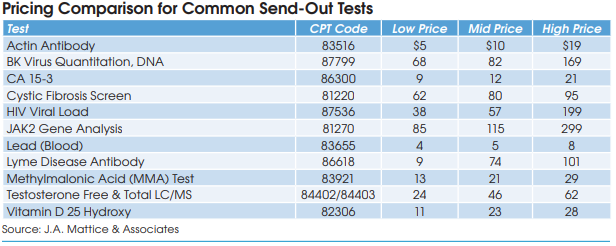

There is a wide variation (see table). For example, we have found that some hospitals pay their reference lab as little as $9 for Lyme Disease Antibody tests (CPT 86618), while others pay as high as $101. It’s not like shopping at the supermarket where you can easily compare prices. In reference testing, like most of healthcare, nobody knows what the other guy is charging.

What kind of savings are you typically able to achieve?

Historically, we have averaged in the range of 23% to 27% savings for each new three-year reference testing contract. However, over the past year, labs have begun to experience inflationary pressure on wages, reagents, paper supplies, courier services, etc. As a result, we’ve started to see the big reference labs draw a harder line on pricing.

Have there been any new entrants in reference testing to challenge the “big four?”

There are a handful of large health systems and academic medical centers competing on a regional basis and Sonic Reference Laboratory has been making some inroads into the market over the past few years.