FDA Finalizes LDT Regulation; Partial “Grandfather” Exemptions for Existing LDTs

FDA Finalizes LDT Regulation; Partial “Grandfather” Exemptions for Existing LDTs

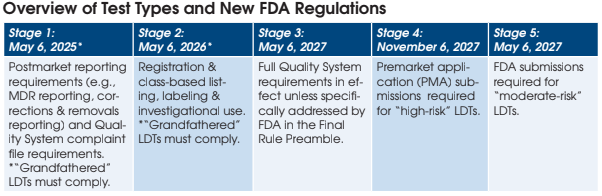

Although less severe than the FDA’s initial proposed regulations, the Final Rule (published May 6) will add a new complex layer of bureaucracy for labs offering laboratory-developed tests (LDTs). LDTs on the market prior to May 6 will not have to go through the full FDA application and clearance process. However, labs will need to develop quality system complaint files, registration, labeling, etc. for each LDT they currently offer. New LDTs will ultimately need to go through the full FDA application and

clearance process.

Jonathan Genzen, MD, PhD, Chief Medical Officer and Senior Director of Governmental Affairs at ARUP Laboratories (Salt Lake City, UT), has been closely following the FDA’s movement toward regulating laboratory developed tests. Below we summarize Dr. Genzen’s perspectives on the Final Rule with an emphasis on what it means for currently marketed LDTs.

What are the Stage 1 requirements for “grandfathered” LDTs under the Final Rule?

These tests are not fully “grandfathered” under the Final Rule, as certain FDA oversight requirements still apply.

Currently marketed LDTs (on the market prior to May 6, 2024) will need to comply with FDA Medical Device Reporting (MDR) regulations. This includes reporting certain device-related adverse events and product problems to the FDA, as well as correction and removal reporting requirements.

Currently marketed LDTs will also need to comply with one of the Stage 3 quality system requirements (Complaint Files — 21 C.F.R. 820.198). Laboratories will be required to establish and maintain procedures for receiving, reviewing, and evaluating complaints for their LDTs.

The Stage 1 requirements will need to be met by May 6, 2025.

What are the Stage 2 requirements for “grandfathered” LDTs under the Final Rule?

Currently marketed LDTs will need to comply with FDA registration, listing, labeling, and investigational use requirements by May 6, 2026. The most complex of these requirements is labeling. It appears that all LDTs eligible under the currently marketed enforcement discretion policy will need to meet full FDA labeling requirements for IVDs. This will be a complex task to conduct retrospectively, as labeling requirements are extensive and will need to be completed within two years to remain in compliance with the Final Rule.

Which anatomic pathology services are covered under the Final Rule for LDTs?

From my interpretation, with the exception of manual staining and manual immunohistochemistry (“1976-type” LDTs), the Final Rule doesn’t distinguish between AP and CP testing. The Final Rule appears to apply to all LDTs, with the exception of manual interpretation of the final slides by a pathologist. This means that currently performed anatomic pathology LDTs, including non-manual IHC staining, are now subject to FDA oversight.

What happens when an existing LDT is modified?

The moment a currently marketed test has a modification considered to be significant by the FDA (and they provide representative examples in the Final Rule), then the LDT would be subject to additional QS requirements including design controls, purchasing controls, acceptance activities, corrective and preventive action (CAPA), and records requirements. Such modifications to existing LDTs will also require a premarket submission to the FDA.

Over time, I anticipate that many routine test modifications, including sample type changes and automation of manual assays on liquid handlers, will now necessitate FDA submissions. And I suspect that the FDA is underestimating the number of tests that will ultimately need to go through premarket review, as well as the financial impact to the clinical laboratory community.

Is the NYS CLEP less expensive and a quicker process than FDA review?

I believe that LDT submission and review under the NYS Clinical Laboratory Evaluation Program (CLEP) – which oversees clinical laboratory testing for NY patients – is available only to NYS-accredited labs. NY clinical laboratory accreditation is likely not a practical option for most laboratories that do not intend to perform testing on NY patients. The NY CLEP performs outstanding, high-quality work, and they will need to share their perspective on how the program should or should not be used in the context of the FDA’s Final Rule.

Is a lawsuit challenging FDA’s authority to regulate LDTs likely?

I believe that litigation is very likely. The FDA’s language in the Final Rule regarding “illegality” (page 30) makes this even more likely in my opinion. If not following the FDA’s new framework for LDTs is deemed illegal—even if it compromises the ability to care for patients (e.g. emergency validations for clinically urgent testing in acute settings) – then the lab industry has been backed into a corner and judicial review could be the only remaining remedy.