New Market Research Report on U.S. Clinical Laboratory Market

Laboratory Economics has just released The U.S. Clinical Laboratory Industry Forecast & Trends 2023-2025. With this special report, you can

tap into 100+ pages of proprietary market research that reveals critical

data and information about key business trends affecting the U.S.

laboratory testing market.

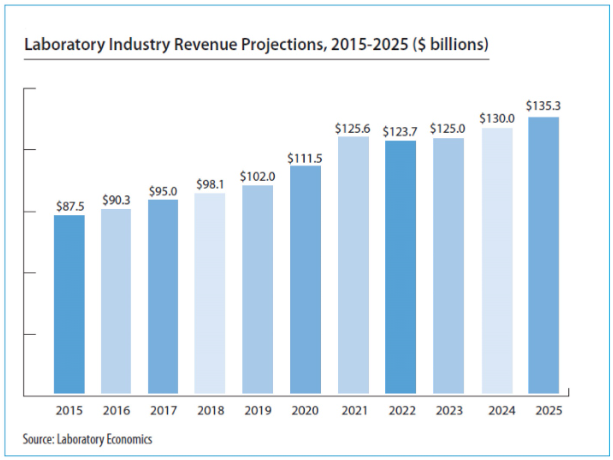

The report reveals that the U.S. laboratory testing market represented

an estimated $125 billion of revenue in 2023 with a long-term annual

growth rate of 3-4%. Growth is currently being driven almost entirely by

increased PCR-based microbiology testing.

The U.S. laboratory testing market faces unprecedented challenges,

including the post-pandemic employee wage inflation, greater utilization

management and claims denials by private payers and persistent

reimbursement pressure. Despite these challenges, the U.S. lab industry

has shown persistent growth.

“The adoption of new higher-priced PCR-based test panels for respiratory

viruses, UTIs and STDs is helping to offset price and volume pressure on

routine clinical lab tests,” according to Jondavid Klipp, President of

Laboratory Economics.

The report includes:

- More than 100 charts and graphs

- U.S. lab market size and growth rates for 2012-2025

- Detailed estimates for market subsets like hospital-based labs,

independent labs, and physician-office-based labs - In-depth analysis of the PCR-based testing market size, growth rate,

and highest-volume laboratories - Top 50 hospital outreach labs by Medicare CLFS and PFS payments

- Detailed reimbursement rate information from Medicare CLFS, Aetna,

Cigna, UnitedHealthcare, etc. - Comprehensive lab M&A valuation metrics by revenue and EBITDA

- Results from Laboratory Economics Clinical Lab Trends Surveys from

2014 through 2023 - The biggest challenges and opportunities for labs

Laboratory companies highlighted include:

- ACL Laboratories

- ARUP Laboratories

- Exact Sciences

- Fulgent Genetics

- Labcorp

- Mayo Clinic Laboratories

- Myriad Genetics

- NeoGenomics

- Northwell Health Labs

- OPKO/BioReference Labs

- PathAI/Poplar Healthcare

- PathGroup

- Quest Diagnostics

- Sonic Healthcare

The U.S. Clinical Laboratory Industry: Forecast & Trends 2023-2025 is

published by Laboratory Economics (www.laboratoryeconomics.com), an

independent market research firm focused exclusively on the business of

pathology and laboratory medicine.