Quest Diagnostics Mid-Year 2020 Review

Quest Diagnostics Mid-Year 2020 Review

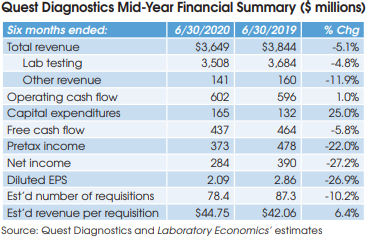

Quest Diagnostics (Madison, NJ) reported net income of $284 million for the six months ended June 30, 2020, down 27.2% from $390 million in the same period for 2019. Overall, Quest’s reported half-year revenue was down 5.1% to $3.649 billion. Looking specifically at Quest’s lab testing business: revenue was down 4.8% to $3.508 billion, including 0.7% gained from acquisitions. Here’s a summary of some key topics discussed during the company’s July 23 conference call with analysts.

Test Volume Trends

Quest reported a 10.2% decline in its requisition volume for the first six months of 2020 versus the same period in 2019. Non-Covid-19 requisition volume fell by approximately 19%.

Quest CEO Steve Rusckowski said volumes were rebounding strongest at primary care offices, including Ob/Gyns, and also for anatomic pathology testing. He said that the weakest volume trends were in life insurance testing, pre-employment drug screening and wellness program testing

for employers.

At the low end of its outlook, Quest is assuming an average 20% decline for its non-Covid-19 requisition volumes through the remainder of the year.

Covid-19 Testing

Quest has performed a total of roughly 8.5 million Covid-19 PCR-based tests year to date through June 30. Quest currently has the capacity to perform up to 130,000 Covid-19 PCR-based tests per day and plans to expand its capacity to 150,000 by early September.

Pooling patient samples for Covid-19 PCR-based tests will help expand capacity. Quest has begun combining four patient samples for pooled testing in locations where Covid-19 positivity rates are less than 5% (e.g., the Northeast). Quest has stated that it plans to bill for four tests when it performs pooled testing on four patient samples.

Meanwhile, Quest has performed a total of more than 2.5 million Covid-19 antibody tests year to date through June 30. Quest is currently performing about 20,000 antibody tests per day, well below its capacity for 200,000.

UnitedHealthcare’s Preferred Lab Network

Rusckowski said that as a member of UnitedHealthcare’s Preferred Lab Network, Quest had secured business from more than 180 out-of-network UHC labs.

Lab Acquisitions

“If anything, the pandemic could be an additional catalyst to help drive industry consolidation. Some transactions in the pipeline that were paused

because of the pandemic are being revisited,” said Rusckowski. Quest acquired Memorial Hermann Diagnostic Labs for $120 million on April 6, and completed its purchase of 100% of the joint venture Mid America

Clinical Labs in early August.