Did Digital Pathology Utilization Increase During The Pandemic?

Did Digital Pathology Utilization Increase During The Pandemic?

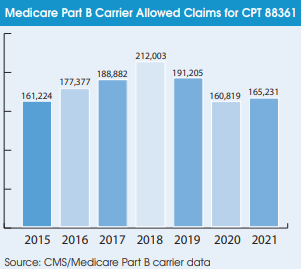

The conventional wisdom says that digital pathology use surged as a result of the pandemic. However, Medicare data for CPT 88361 (computer-assisted IHC for breast cancer) tells a different story. The volume of Medicare Part B allowed claims for 88361 declined by 16% to 160,819 in 2020, followed by only a 3% rebound to 165,231 in 2021. CPT 88361 is the only code devoted specifically to bill Medicare for reading digitized slides. It therefore gives an indication of digital pathology trends in the clinical market.

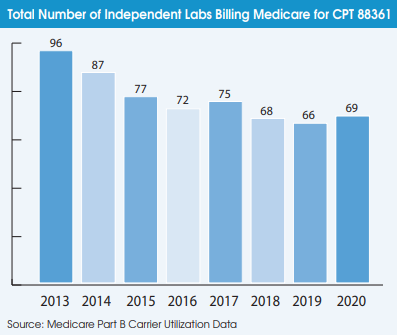

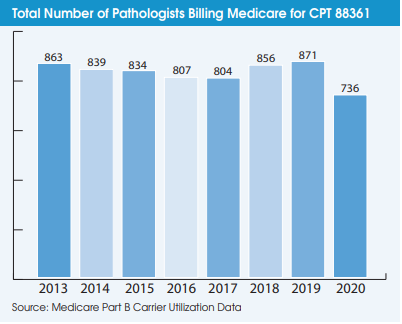

Another indication that the digital pathology market has not taken off during the pandemic is the falling number of pathologists using it. A total of 736 pathologists billed Medicare for CPT 88361 in 2020 (the latest year of available data), which was down from 871 pathologists in 2019. The number of independent labs billing Medicare for CPT 88361 declined from 96 labs in 2013 to 66 labs in 2019 but increased slightly to 69 labs in 2020.

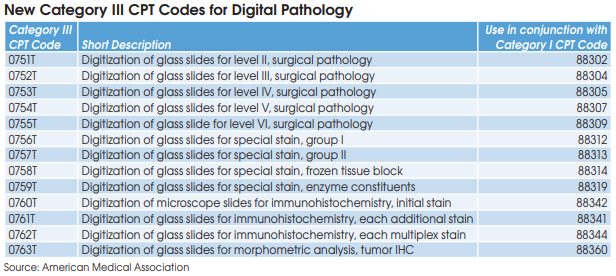

The main barrier, irrespective of the pandemic, to more widespread adoption of digital pathology has been the added expense of digitizing slides without reimbursement. The problem is that digital pathology comes as an “add on” process that is produced from a traditional glass slide. Digital pathology does not eliminate the need to process, section, glass-slide-mount and stain biopsy specimens. A high-end conventional microscope costs between $9,000 and $12,000, while a complete digital pathology

system can cost between $100,000 and $400,000.

In addition, pathologist practice patterns are hard to change, especially without a clear clinical benefit and/or compelling financial incentive.

Artificial intelligence could be the game changer that jumpstarts the digital pathology market. AI-based decision-support tools that boost pathologist productivity and reduce errors need digitized images to read. AI vendors (PathAI, Paige, Ibex Medical Analytics, etc.) claim their software can help pathologists read 30+% more slides per day. This may provide hospitals and labs with the return on investment necessary to justify an investment in digital pathology scanners.