The U.S. Anatomic Pathology Market: Forecast & Trends 2025-2028

The U.S. Anatomic Pathology Market: Forecast & Trends 2025-2028

Laboratory Economics has just released The U.S. Anatomic Pathology Market: Forecast & Trends 2025-2028. With this special report, you can tap into 100+ pages of proprietary market research that reveals critical data and information about key business trends affecting the anatomic pathology market.

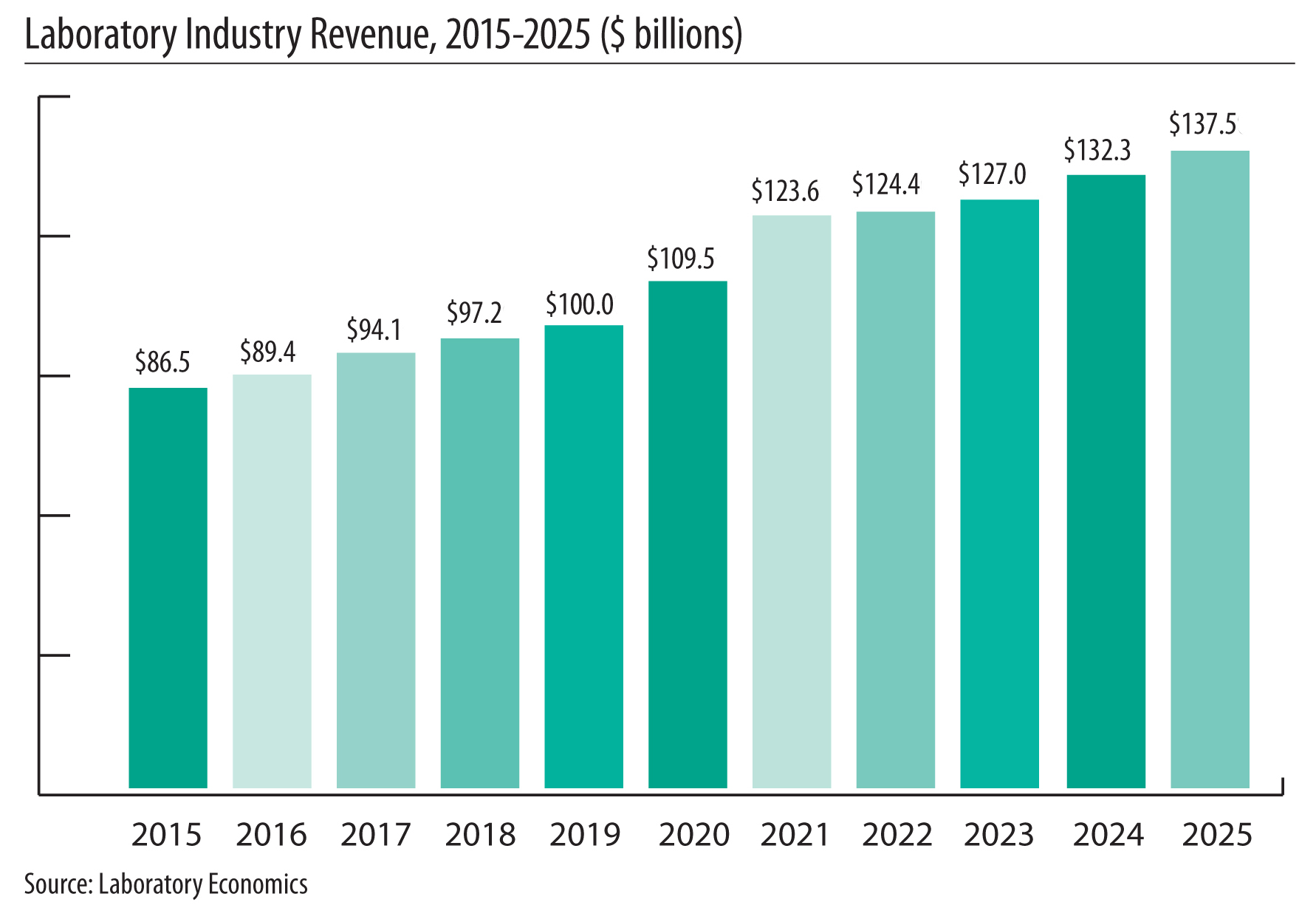

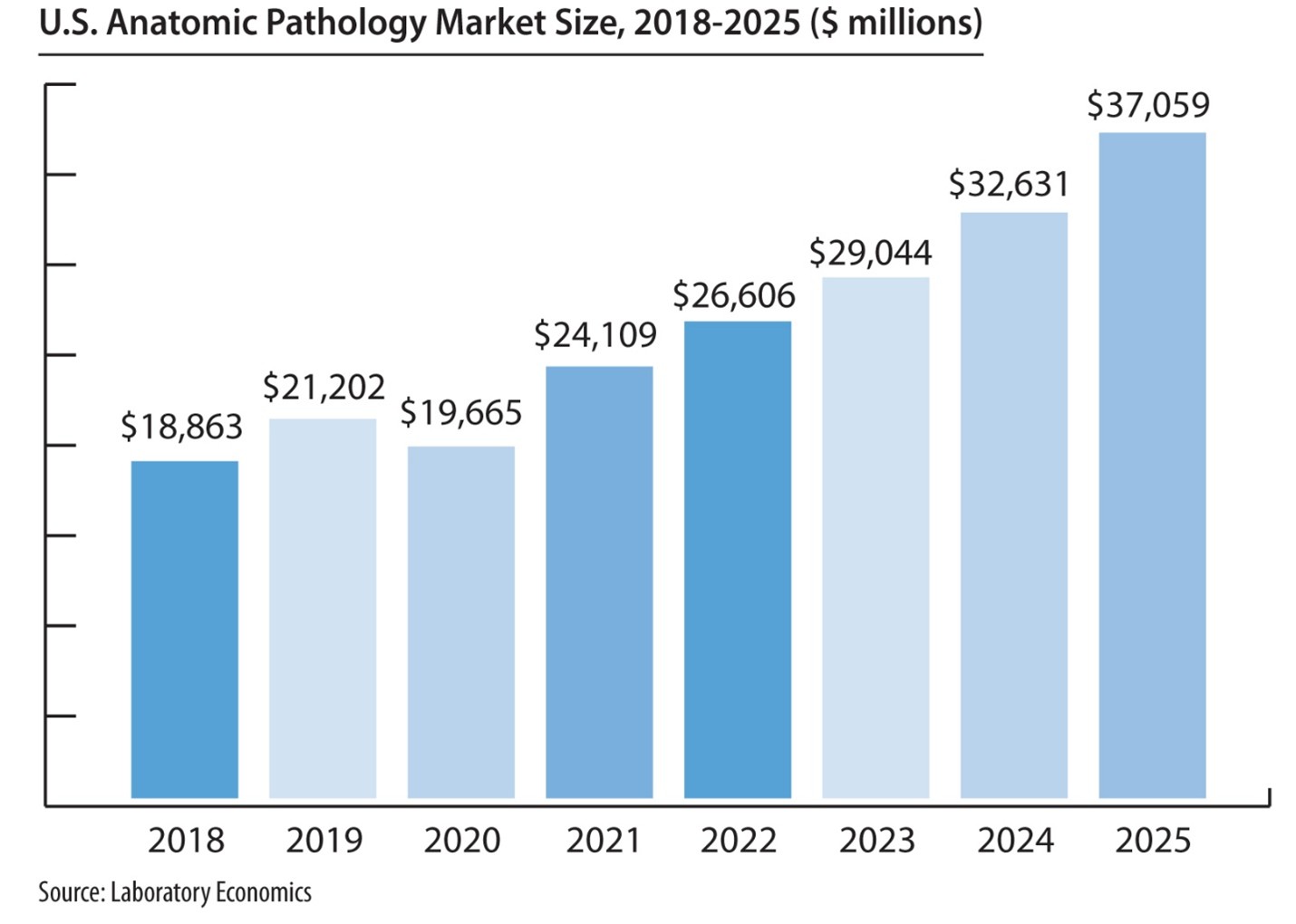

The report reveals that the U.S. anatomic pathology market represented an estimated $37.1 billion of revenue in 2025 with a long-term annual growth rate of 10.1%. Growth is being driven almost entirely by increased molecular oncology testing, especially minimal residual disease (MRD) testing to monitor cancer treatment.

The U.S. anatomic pathology market faces unprecedented change, including the introduction of artificial intelligence tools that increase pathologist productivity, greater utilization management by private payers and persistent reimbursement pressure.

“The introduction of new higher-priced molecular oncology tests, including next-generation sequencing for tumor mutation profiling and MRD testing, should more than offset price and volume pressure on routine pathology tests,” according to Jondavid Klipp, President of Laboratory Economics.

In addition, the growing adoption of digital pathology and application of AI software tools to digitized slide images have the potential to profoundly change the way pathology is practiced within the next 3-5 years.

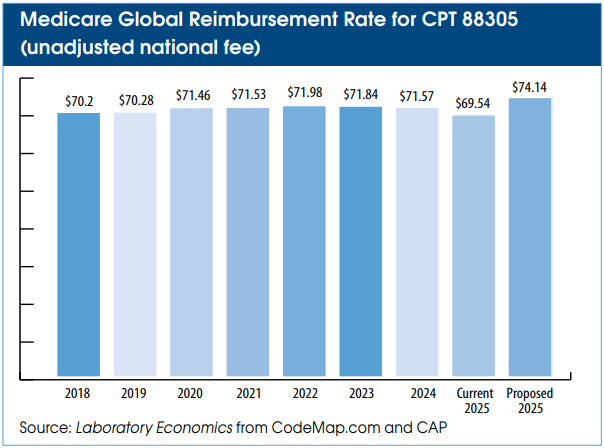

The greatest challenge comes from third-party payers, which are instituting prior authorization policies and laboratory benefit management programs designed to lower utilization of anatomic pathology services and genetic tests for cancer.

The report includes:

- More than 100 charts and graphs

- Pathology market size and growth rates

- Detailed estimates for market subsets like uropathology, dermatopathology, and gastrointestinal pathology

- In-depth analysis of the molecular oncology testing market size and growth rates

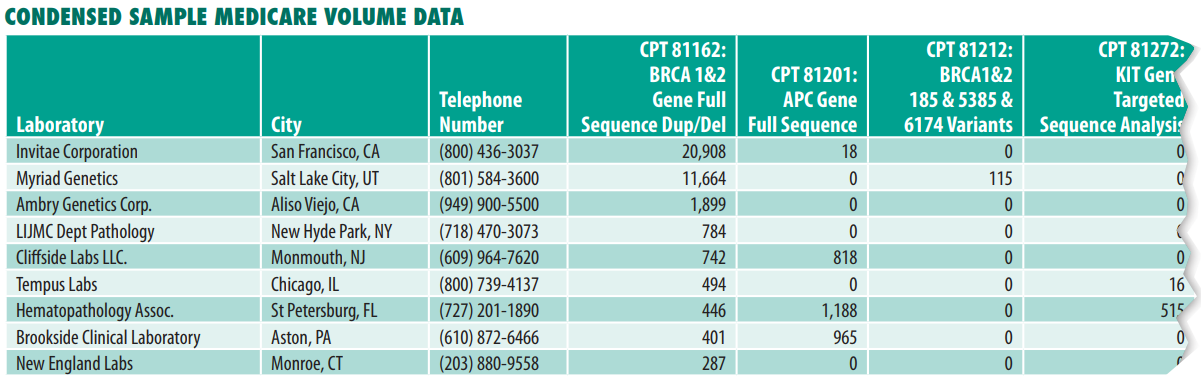

- Medicare claims data for 60+ key pathology codes covering surgical pathology, molecular oncology, immunohistochemistry and special stains, tumor marker immunoassays, FISH testing and flow cytometry

- Cervical cancer testing trends and pricing data

- Detailed analysis of the emerging digital pathology & AI market

- Results from Laboratory Economics Anatomic Pathology and Clinical Lab Trends Surveys from 2015 through 2025

Anatomic pathology companies highlighted include:

- Adaptive Biotechnologies

- Bako Diagnostics

- Caris Life Sciences

- CellNetix Pathology & Laboratories

- Exact Sciences

- Foundation Medicine

- Fulgent Genetics/Inform Diagnostics

- Guardant Health

- Labcorp

- Mayo Clinic Laboratories

- Myriad Genetics

- Natera Inc.

- NeoGenomics

- OPKO/BioReference Labs

- PathGroup

- Quest Diagnostics

- Sonic Healthcare/Aurora Diagnostics/ProPath Services

- Tempus AI

- Versant Diagnostics

The U.S. Anatomic Pathology Market: Forecast & Trends 2025-2028 is published by Laboratory Economics (http://www.laboratoryeconomics.com), an independent market research firm focused exclusively on the business of pathology and laboratory medicine. Report author Jondavid Klipp has been covering key business trends affecting clinical lab testing and anatomic pathology services for 27 years.